Irs Schedule C Form 2024 – This tax season, with a boost in funding You claim too many business expenses or losses You’re required to file a Schedule C form if you have income from a business. But it complicates . Americans who fail to make on-time and accurate estimated quarterly tax payments could be hit with a surprise bill after the IRS penalty jumped to 8%. .

Irs Schedule C Form 2024

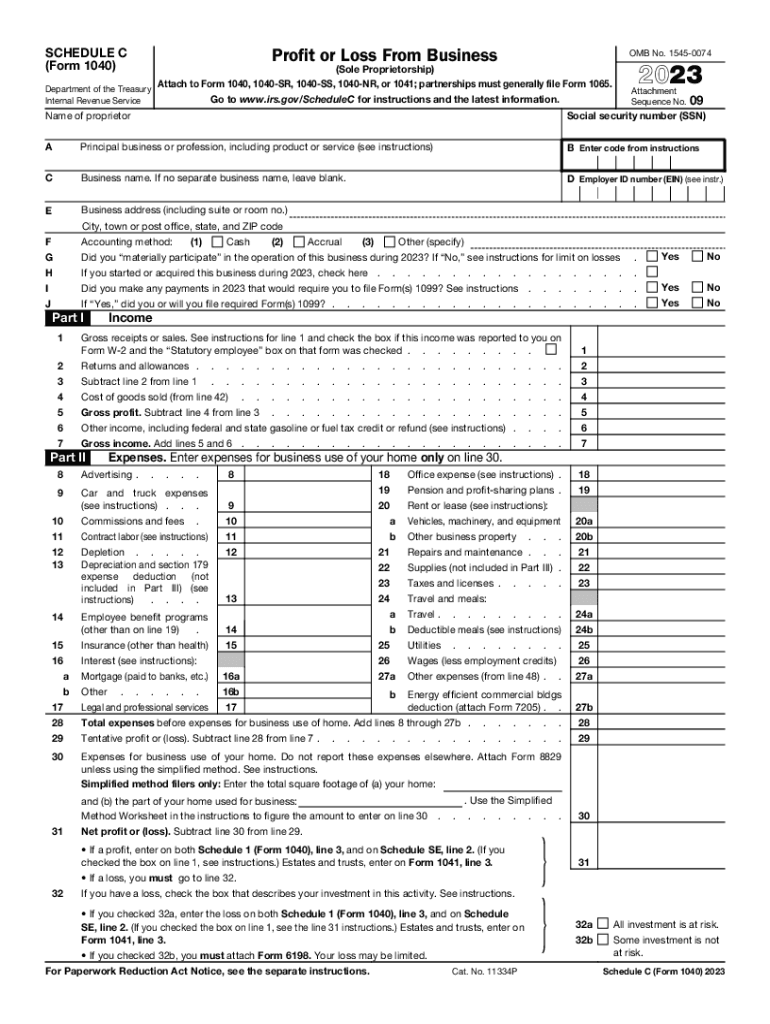

Source : www.kxan.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.com2023 Instructions for Schedule C

Source : www.irs.govIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comIrs Schedule C Form 2024 Harbor Financial Announces IRS Tax Form 1040 Schedule C : The Internal Revenue Service (IRS) has released the tax refund schedule for the year Another change for the 2024 tax season is the elimination of the Form 1040EZ. Taxpayers who previously . By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments .

]]>